Table of Content

- Home Loan Eligibility Details

- How do I Improve My Chances of Getting a Home Loan?

- Statutory / Regulatory Charges

- HDFC raises home loan rates by 35 bps, effective from December 20

- What are the different types of Home Loans available in India?

- Business News Live On December 20: Stocks In Focus - HDFC, Dabur, IRCTC, Wipro & More

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. With minimal documentation, applying for a HDFC home loan is quick and hassle free. Our home loan experts are available to help you in your loan application process and offer you assistance every step of the way. With a growing need for affordable housing and a largely underpenetrated market, IFC's loan to HDFC underscores the fact that lending to underserved populations is viable, said Hector Gomez Ang, regional director for South Asia at IFC. Meanwhile, private sector lender Axis Bank has hiked its marginal cost of funds-based lending rate by 30 bps, effective December 17, the bank said on Monday.

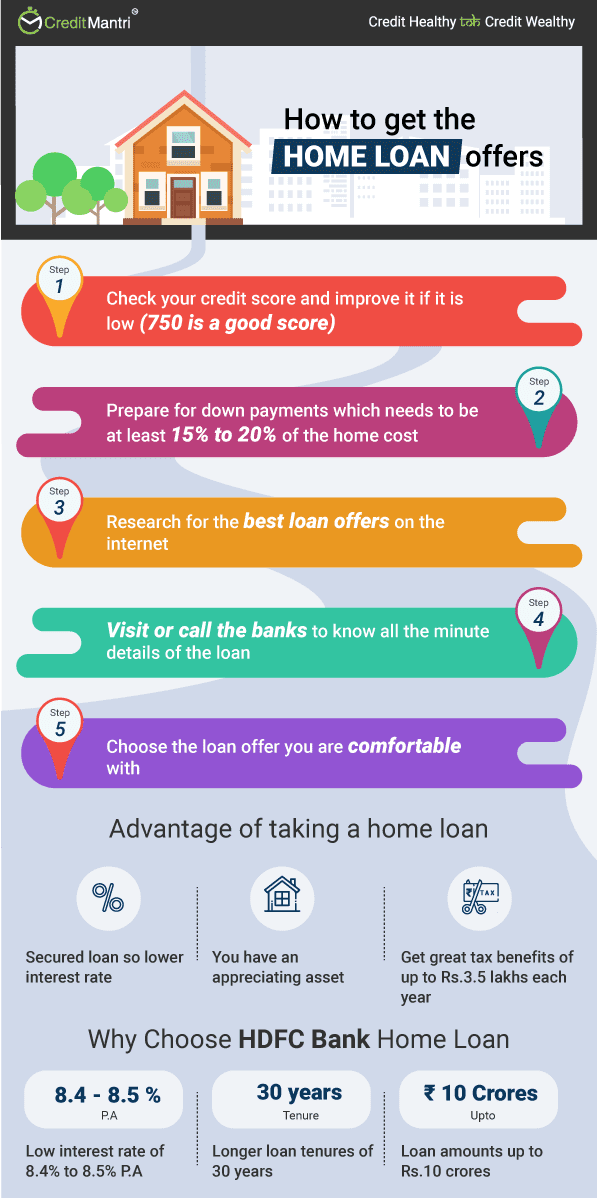

You can now apply for a home loan online conveniently from anywhere and at anytime. So start the process of owning your dream home from the comfort of your home. Security of the loan would generally be security interest on the property being financed and / or any other collateral / interim security as may be required by HDFC. The Pradhan Mantri Awas Yojana -Housing for All was a mission that was launched by the Government of India with the aim of boosting home ownership. The PMAY scheme caters to Economical Weaker Section /Lower Income Group and Middle Income Groups of the society, given the projected growth of urbanization & the consequent housing demands in India. For home loans and balance transfer loans, the maximum tenure is 30 years or till the age of retirement, whichever is lower.

Home Loan Eligibility Details

With a growing need for affordable housing and a largely underpenetrated market, IFC's loan to HDFC underscores the fact that lending to the underserved populations is viable, said Hector Gomez Ang, regional director for South Asia at IFC. As per the statement, HDFC Ltd. provides cheap home loan interest rates starting at 8.20% annually . The interest rate for people who don’t have the necessary credit score might range from 8.40% to 8.90%. Up to 25% of the initial principal loan amount may be prepaid without incurring any fees after the first six months and for a maximum of 36 months.

Mortgage lender HDFC has hiked its home loan rates by 35 basis points , effective December 20, the company said in a statement on Monday. Now, the home loan rates for HDFC will start from 8.65 per cent for credit scores of 800 and above. If the home loan is being prepaid in the first 6 months, then 2% of the amount being prepaid in addition to the applicable taxes and other statutory charges will be levied. You must submit an online payment using internet banking or do what you normally do for EMIs.

How do I Improve My Chances of Getting a Home Loan?

The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Fees on account of external opinion from advocates/technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. Up to 0.50% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes.

You can apply for a home loan online from the ease and comfort of your home with HDFC’s online application feature. Alternatively, you can share your contact details here for our loan experts to get in touch with you and take your loan application forward. The Borrower will be required to submit such documents that HDFC may deem fit & proper to ascertain the source of funds at the time of prepayment of the loan. If you are already a registered user of The Hindu and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.

Statutory / Regulatory Charges

Residential housing accounts for around 24% of the country's electricity consumption. Residential housing accounts for around 24 per cent of the country's electricity consumption. The companies said in separate statements today said this loan will help close the urban housing gap and improve access to climate-smart affordable homes by boosting green housing. Residential housing accounts for around 24% of India's electricity consumption. Since 2010, IFC has invested over $1.7 billion in India's housing finance companies for on-lending to retail buyers of affordable housing and developers of affordable and green housing.

The EMIs will proportionately increase with every partial disbursement made as per the progress of construction. You can apply for housing loans at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced. You can even apply for a home loan whilst you are working abroad, to plan for your return to India in future.

Once you avail a HDFC home loan, you can access your home loan account online on our website. You can download account statements, interest certificates, request for disbursement and do much more. Our HDFC Reach Loans make home buying possible for micro-entrepreneurs and salaried individuals who may or may not have sufficient proof of income documentation. You can apply for a house loan with minimal income documentation with HDFC Reach. All co-owners of the property need to be co-applicants to the house loan. Plot purchase loans are availed for purchase of a plot through direct allotment or a second sale transaction as well as to transfer your existing plot purchase loan availed from another bank /financial Institution.

It is estimated that 275 million people in the country, or 22% of the over 1.4 billion population, do not have access to adequate housing, and rural housing shortage is twice that of urban areas. It is estimated that 275 million people in the country or 22 per cent of the over 1.4 billion population do not have access to adequate housing, and rural housing shortage is twice that of urban areas. As of 2018, the urban housing shortage was 29 million units, increasing by over 54 per cent since 2012. The move by India’s largest NBFC follows a 35-basis point increase in the repo rate by the Reserve Bank of India on December 7, 2022.

Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority. It is a warm little corner in the world that is yours, tailored by your tastes and needs. It is the place where you celebrate the joys and enjoy the journey called life.

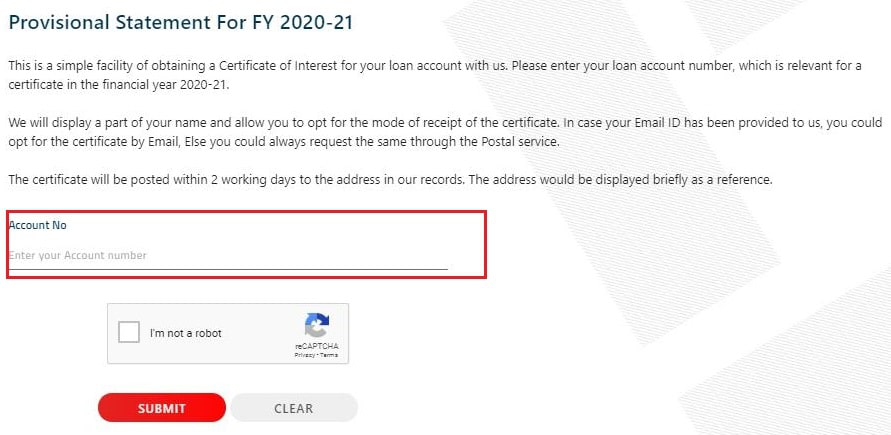

You will be taken to the loan application form where the details you have already provided will be prefilled. Fill in the balance details – your date of birth and password and click on ‘Submit’. For your convenience, HDFC offers various modes for repayment of your house loan.

You can prepay your home loan before the completion of your actual loan tenure. Please note that while there are no prepayment charges on floating rate home loans unless the same availed for business purposes. In an adjustable or floating rate loan, the interest rate on your loan is linked to your lender’s benchmark rate. Any movement in the benchmark rate will effectuate a proportionate change in your applicable interest rate.

No comments:

Post a Comment